Planning for 2026 ACA Marketplace Premium Tax Credits: How to Avoid the Income Cliff

Quick Note: We’re publishing this on Tuesday, November 25, 2025. Congress could pass new laws that change the rules surrounding health insurance from the ACA/Marketplace and premium tax credits at any time. As of this writing, several proposals to extend or modify these tax credits are being discussed in Congress and by the White House, but none have been passed into law. It’s important to check for updates as this situation progresses. We suggest preparing to take action now, so that you’ll be ready to implement your plan if/when it’s needed.

If you’re retired, younger than 65, and will be on ACA/Marketplace health insurance for all or part of 2026, this is something to have on your radar. Under current law, there could be some big changes in what you pay for coverage — in some cases, one extra dollar of income in 2026 could mean paying over $20,000 more per year for the same health insurance plan.

Here’s the basic issue: the rules for how ACA premium tax credits will be calculated in 2026 are still up in the air. If Congress doesn’t act, the “old” rules are scheduled to come back, including an income cliff where going even $1 over a certain income level can completely eliminate your premium tax credit. Everything in this post is based on today’s laws and illustrative estimates, and the actual rules and dollar amounts for 2026 could end up looking different.

Before we get too far, I’ll admit this post isn’t exactly light reading. But this situation could have huge ramifications, and I felt it deserved time and attention. If you’d rather skip to the condensed version, you can jump to the TL;DR summary section using the following link:

(Important note: This is general education, not personal tax, investment, or legal advice. Talk with your tax professional and, if appropriate, your financial advisor before making changes based on this information.)

Key concepts: how ACA premium tax credits work

Before we get into examples and planning ideas, here are the key concepts to understand:

ACA premium tax credits are based on your Modified Adjusted Gross Income (MAGI) for the year you have Marketplace coverage. The credit reduces the premium you actually pay each month. For example, if your plan’s base premium is $1,000/month and you qualify for a $700/month credit, your out-of-pocket cost is $300/month.

You have to estimate your income for the year up front. When you apply for coverage, you estimate your MAGI for the coming year. If you overestimate, it could increase your tax refund the following year. If you underestimate, you may have to pay back some or all of the credit when you file your taxes.

In 2025, credits phase out gradually. The amount of premium tax credits you receive phases out gradually as your income increases and can eventually be reduced to $0 once the cost of a benchmark Silver premium plan is less than about 8.5% of your MAGI. In other words, there isn’t one hard upper income cutoff in 2025.

For 2026, things could be very different. If nothing changes in Washington, the rules in 2026 would revert to the pre-2021 system. That includes a hard income cap (400% of the federal poverty level) for premium tax credits. Go even $1 over that line, and your credit can drop from a very large number to zero. That’s the “income cliff.”

Congress could still change the rules. Lawmakers could extend the current system, let the old rules come back, or introduce a new structure altogether. We don’t know whether Congress will step in; there are active proposals on the table, but nothing has passed yet. So for planning purposes, it’s safer to assume the cliff returns in 2026 under current law and adjust if we get good news later. It makes sense to understand the worst-case scenario now so you’re ready to adjust before year-end if needed.

What the cliff could look like in real life

Much like in 2025, your premium tax credit in 2026 would still shrink as your income rises within certain ranges. The big difference is that under the “old” rule set, there’s now a point where your credit doesn’t just taper off — it falls off a cliff.

To make this concrete, let’s look at a couple of hypothetical examples (one couple and one individual) using sample 2026 premiums from the plan preview tool on Healthcare.gov. These numbers are simplified estimates for illustration only. Actual premiums and premium tax credits will vary based on your specific situation, the plans you choose, and when you apply.

Example #1 – Married Couple in their early 60s in Southeast Nebraska

Here’s the hypothetical couple’s situation, along with expected premium costs for the cheapest available Bronze and Silver plans as found through the Marketplace on Healthcare.gov.

Personal Details

· Husband: Age 63

· Wife: Age 61

· Zip Code: 68106

· No dependents (household size: 2)

· Both spouses need ACA coverage

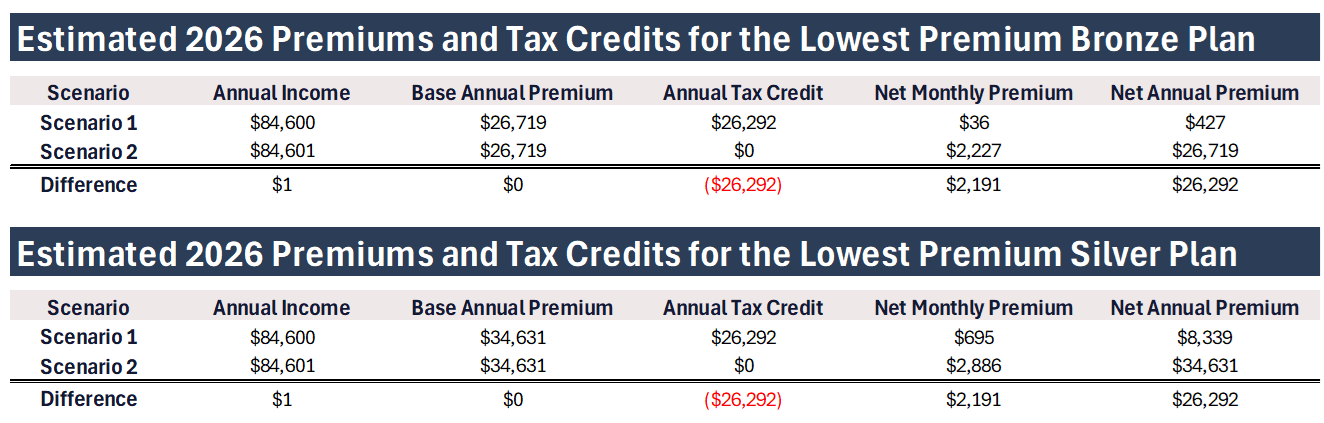

The chart below shows the estimated 2026 premiums and premium tax credits for this couple’s lowest-cost Bronze and lowest-cost Silver plans at two slightly different income levels: $84,600 and $84,601. As you’ll see, that extra $1 of income takes their annual premium tax credit from roughly $26,000 to $0, and their net premiums jump by over $26,000 per year for the same coverage.

A $1 increase in income causes a $26,292 increase in annual premiums for this couple.

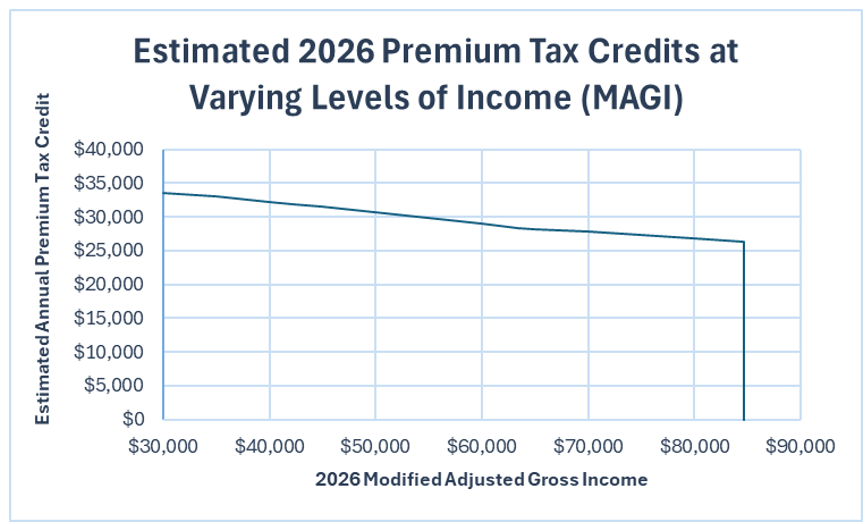

And here it is as a line graph, to really illustrate the “cliff”:

Example #2 – Single individual in their early 60s in Southwest Iowa

Now let’s look at a hypothetical individual and the cheapest available Bronze and Silver plans on Healthcare.gov.

Personal Details

· Female: Age 62

· Zip Code: 51503

· No dependents (household size:1)

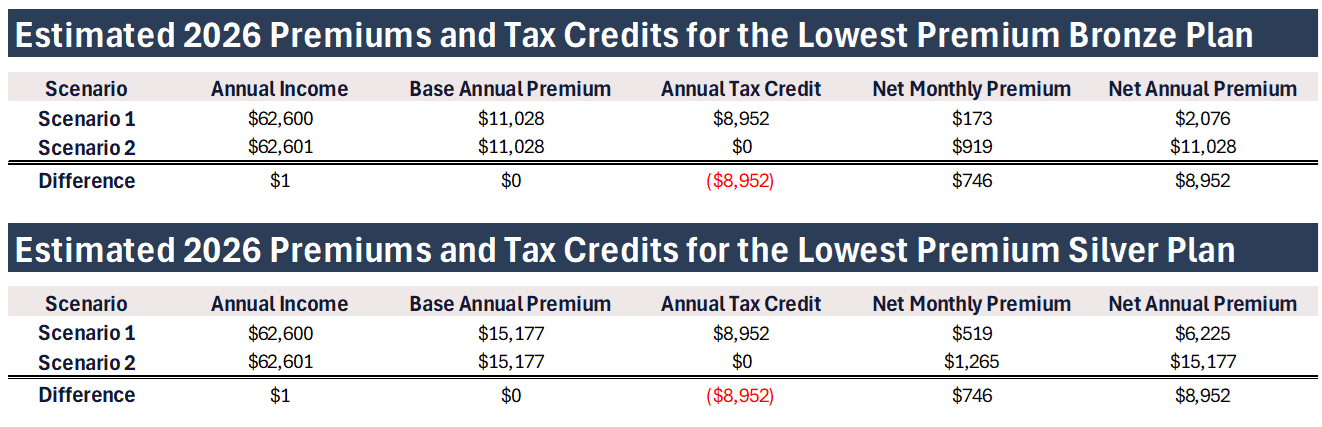

The chart below shows the estimated 2026 premiums and premium tax credits for this individual’s lowest-cost Bronze and lowest-cost Silver plans at two slightly different income levels: $62,600 and $62,601. As you’ll see, that extra $1 of income takes their annual premium tax credit from roughly $8,952 to $0, and their net premiums jump by that same amount for the same plan.

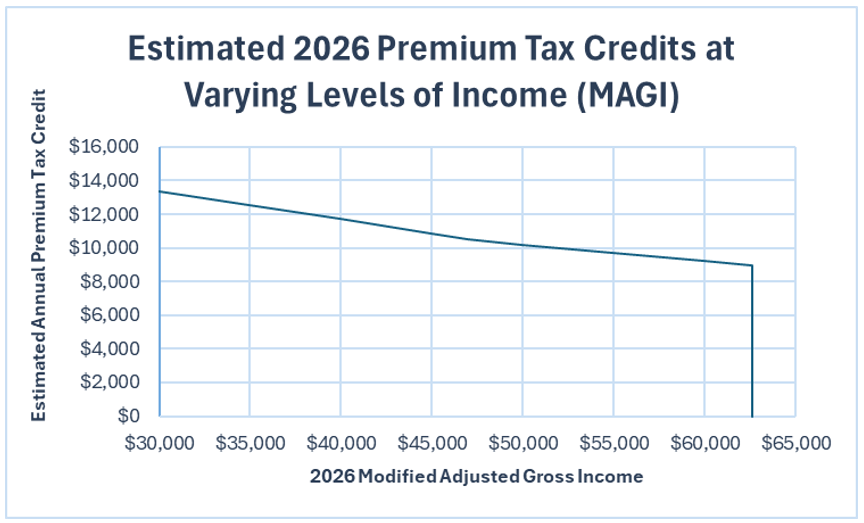

And again as a line chart:

Clearly, this is a big deal. While complaining about this system may be warranted, the most important thing to do now is prepare. With proper planning ahead of time, it’s often possible to keep your premiums more manageable while you wait to presumably join Medicare at age 65.

We’ll start high-level, then dive a bit deeper into some actionable strategies you could consider implementing.

How to know where the “cliff” is for your situation

Identifying the cliff is step one. From the charts above, it’s easy to see that if there are steps you can take to stay to the left of — or comfortably below — the cliff while still enjoying your desired retirement lifestyle, that’s a good outcome.

Here’s how to find that income level for your own situation, assuming the “old” rules come back in 2026:

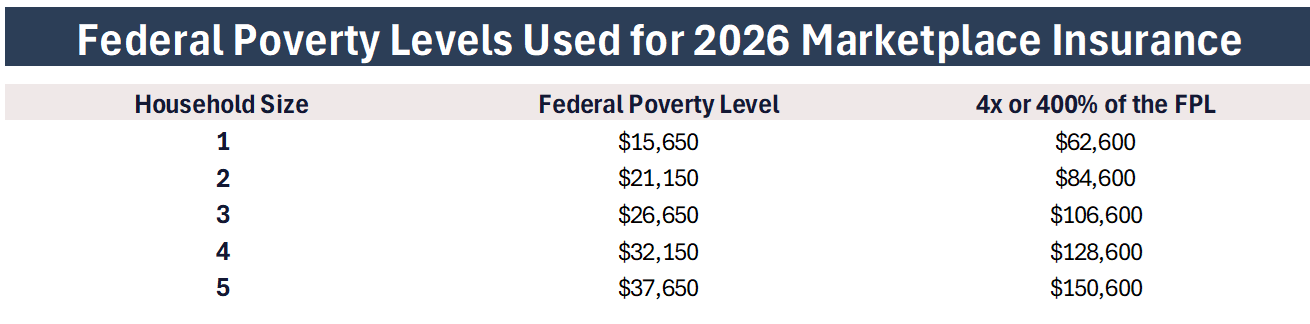

The location of the income cliff is based on 400% of the Federal Poverty Level (FPL). The FPL is an income figure provided each year by the Department of Health and Human Services (HHS). The cliff generally sits at 4 times that number for your household size.

FPL depends on household size. Typically, your household includes the tax filer + spouse + tax dependents, but there are some exceptions. HealthCare.gov has a helpful guide on determining your household size: Who’s included in your household | HealthCare.gov

FPL also scales up for larger households. Below are some of the figures published by HHS, along with a calculation of 400% of the FPL so you can see the locations of the cliffs. For larger household sizes, you can see the full list on HealthCare.gov here: Federal Poverty Level (FPL) - Glossary | HealthCare.gov

What income “counts”?

The amount of your ACA premium tax credits — and whether or not you go over the cliff — is based on Modified Adjusted Gross Income (MAGI). MAGI is a term used often in tax and financial planning, but there are multiple definitions that apply to different situations. Here’s the definition that applies specifically to ACA premium tax credits:

Start with Adjusted Gross Income (AGI). At a high level, this includes all of your taxable income sources before the standard or itemized deduction (or other “below-the-line” deductions).

Then add back the following items:

Excluded foreign income

Nontaxable Social Security benefits (for tax purposes, only up to 85% of Social Security income is taxable and for some people that percentage is lower, but for this calculation, you add back the portion that’s excluded from taxation)

Nontaxable Tier 1 Railroad Retirement benefits

Tax-exempt interest (such as interest from municipal bonds)

Once you’ve calculated your ACA MAGI using this definition, you can compare it to the 400% FPL number for your household size to see how much cushion you have before hitting (or crossing) the cliff.

This is a simplified overview of the ACA MAGI rules; your tax preparer or the IRS instructions for Form 8962 can help you calculate the exact figure for your situation.

What can you do?

First, to figure out whether planning will make a difference for you, it helps to sort your income into two buckets:

“Non-controllable” income: Income that’s going to come in whether you want it to or not. Examples might include pension payments you’ve already started and can’t change easily, certain annuity payments, or other fixed income sources.

“Controllable” income: Income where you have some control over the amount or timing. For example, non-RMD IRA distributions you can choose the timing of, realizing capital gains (or losses), Roth conversions, or work income you can partially shelter via pre-tax contributions.

If your non-controllable income by itself is already well past the cliff level that applies to you and your household, there may not be many levers available to preserve ACA premium tax credits. In that case, the focus may shift more toward building your retirement spending plan around the higher, unsubsidized premium levels.

For everyone else whose controllable income is either estimated to be below, or relatively close to, their applicable income cliff, it can be helpful to look at potential planning options to see what might be done to help keep premiums more reasonable.

At their core, each of the strategies below is about planning to manage MAGI in 2026 and beyond (depending on how long you have until you switch to Medicare). We’ll break these strategies into two groups:

Strategies that involve pulling future income forward into 2025 (and thus require action before the end of this year), and

Strategies that involve reducing income through deductions or other income reductions in 2026.

These aren’t the only possible strategies, but they’re common levers for many retirees in the ACA window.

And a quick note before we dive in: much like cliffs in real life, it’s safest to enjoy the view from a distance. Put another way, give yourself some wiggle room if you can. The last thing anyone wants is for their savings account to pay $1 more of interest than expected and for that extra dollar to result in losing a $26,000+ tax credit.

Alright, let’s dive in:

Strategies that involve pulling future income forward into 2025

The goal with strategies that involve pulling income forward into 2025 is twofold:

Reduce future “non-controllable income.”

The idea is to lower the amount of income that would otherwise have to be realized (and therefore count as part of MAGI) during the years when you may be susceptible to the ACA premium tax credit income cliffs.Create additional liquidity that can be accessed later with little or no impact on MAGI.

You’re still going to need cash to live on while you wait to start Medicare. But cash doesn’t necessarily equal taxable income. In an ideal scenario, the liquidity you build up now would last until after you reach age 65 and move onto Medicare.

For example, distributions from a traditional IRA increase your MAGI in the year you take them, but qualified distributions from a Roth IRA do not increase MAGI. Similarly, spending down a regular savings account or taxable investments where you’ve already realized the gain may provide cash with minimal additional income.

As with most things in financial planning, there are tradeoffs to consider. The main one here is that any income you choose to realize in 2025 will be taxable in 2025, at whatever your 2025 tax rates are.

If you’re still working in 2025 but retiring soon, that could mean some of this income is taxed at a higher rate in 2025 than it would have been if you had waited until 2026 or later. The difference in tax rates could be just a couple of percentage points—or more than 30%—depending on your situation, so it’s definitely something to weigh carefully with your tax professional.

However, if the choice is between:

realizing long-term capital gains at a 15% federal tax rate in 2025 to help preserve your 2026 ACA premium tax credit, or

realizing some of those gains at 0% in 2026 but losing your 2026 ACA premium tax credit,

we’ve already seen that the dollar value of the lost credits can be substantial. In many cases, that may make paying some tax in 2025 a tradeoff that’s at least worth carefully considering.

Strategies to Consider:

In practice, it’s not always one strategy that gets implemented. It’s often a combination of strategies used together to help drive better outcomes.

Strategy #1: Realize capital gains in 2025 (a.k.a. “tax-gain harvesting”)

What it means

Within a taxable (non-qualified) brokerage account, interest and dividends earned during the year, plus any gains you realize by selling an investment that has increased in value since you bought it, are generally taxable. Selling investments with gains in 2025 instead of 2026 means that income shows up in your 2025 MAGI instead of your 2026 MAGI.

How it might help

If you know you’re going to need liquidity to live on in 2026 and beyond, selling investments in a taxable brokerage account can be one of the best ways to generate that liquidity while keeping MAGI relatively low.

However, if most of your positions are sitting on large unrealized gains (they’ve gone up a lot since you bought them), that advantage is limited—because every dollar of sales creates taxable capital gains. In that case, it can make sense to intentionally sell some investments earlier and pay the tax in 2025 so you’ll have more “pre-harvested” cash available to spend in 2026 without needing to realize as much income next year. That, in turn, may help protect your 2026 ACA premium tax credit depending on your situation.

Quick example

Let’s go back to our hypothetical couple from southeast Nebraska and assume the following for 2026:

They will have $50,000 of non-controllable pension income.

They want to live on $100,000 total, so they need $50,000 of additional liquidity from another source.

They have a taxable brokerage account holding $200,000 of ABC stock that they originally bought for $20,000. That means there is $180,000 of long-term capital gains built into the position.

Because their cost basis is only 10% of the current value, for every $1 of cash they generate by selling ABC stock, roughly $0.90 is long-term capital gain.

If they sold enough ABC stock in 2026 to generate the full $50,000 of liquidity they need:

Cash raised: $50,000

Long-term capital gains realized: about $45,000

Estimated 2026 MAGI:

$50,000 pension income + $45,000 long-term capital gains = $95,000 MAGI

That puts them roughly $10,400 above the 2026 income cliff for a household of two (using $84,600 as the illustrative 400% FPL level), so in this simplified example they’d be estimated to receive no ACA premium tax credit in 2026.

What if they sold some of the stock in 2025 instead?

Now assume they decide to split the needed sales:

Sell $25,000 of ABC stock in late 2025, and

Sell the remaining $25,000 in early 2026

(Quick side note: waiting to sell introduces market risk and wouldn’t necessarily be our recommendation in the real world—this is just to illustrate the mechanics.)

If there’s no price movement, each $25,000 sale would realize about $22,500 of long-term capital gains.

2025 long-term capital gains: $22,500

2026 long-term capital gains: $22,500

Now their estimated 2026 MAGI looks like this:

$50,000 pension income + $22,500 long-term capital gains = $72,500 MAGI

They still have the full $50,000 of liquidity available to fund 2026 living expenses, but their 2026 MAGI is now below the $84,600 cliff in this example, so they’re estimated to qualify for a substantial ACA premium tax credit instead of $0. The exact credit amount would depend on the final 2026 rules, FPL levels, premiums, and their plan choices.

Tradeoffs to consider

Tradeoff #1 – Potential increase in taxes

Let’s say that by realizing those gains in 2025 they pay a 15% federal tax rate on the capital gains, while realizing them in 2026 would have resulted in a 0% rate under current brackets.

Amount of gain shifted from 0% rate in 2026 to 15% in 2025: $22,500

Extra tax cost in 2025: $3,375 ($22,500 × 15%)

In exchange, our estimate suggests they might preserve a 2026 premium tax credit of roughly $26,000 for the year (about $2,191 per month) instead of losing it entirely. That’s a sizable tradeoff: paying about $3,375 in tax now to potentially avoid losing something in the neighborhood of $26,000+ in premium support next year, based on the assumptions in this example.

Could they get even more aggressive and realize slightly more than half the gains in 2026 to try to take fuller advantage of the 0% capital gains bracket? Possibly. But remember: hugging the cliff is a dangerous game. Trying to save 15% on a slice of capital gains while risking the loss of a potential $26,000+ premium tax credit usually doesn’t look attractive once you see the numbers side by side, though the “right” answer will depend on your broader tax situation and goals.

Tradeoff #2 – Potential reduction in 2025 ACA premium tax credit

Let’s also assume this couple was already retired prior to 2025 and spent the entire year using ACA marketplace insurance. This adds another wrinkle, because now we need to consider the impact that any moves could have not only on the 2026 ACA premium tax credits, but also on the 2025 ACA premium tax credits that have already been received via lower premium payments throughout the year.

At the beginning of 2025, they provided an estimated MAGI this year of $100,000, and they received a monthly premium tax credit of $1,748 or $20,976 for the year. If they decide to realize an additional $25,000 of capital gains in 2025 instead of 2026, that would push 2025 MAGI to $125,000 in this example.

At that higher income level, their estimated 2025 premium tax credit might drop to $1,571 per month (about $18,852 for the year), a reduction of $2,124. That reduction would generally show up as an amount they’d need to repay as part of their 2025 income tax filing.

In this specific example, even after accounting for the 2025 tax impact and the reduced 2025 premium tax credit, the potential 2026 savings from preserving the much larger credit could still come out ahead. But that’s not guaranteed, and the outcome can differ significantly depending on tax brackets, state, plan choices, and future rule changes. It’s important to model how both your 2025 and 2026 premium tax credits might change before deciding to pull any income forward.

Longer-term Planning

Remember that this couple is age 63 (husband) and 61 (wife), so both are still a few years away from reaching 65 and starting Medicare. That means 2026 may not be the only year where the income cliff matters.

With this in mind, they might want to consider creating even more liquidity in 2025, not just enough to cover 2026, but enough to help preserve their ACA premium tax credits for 2026 and the remaining pre-Medicare years as well.

Strategy #2: Roth Conversions in 2025

What it means

Funds distributed from a traditional IRA are typically included in MAGI in the year of the distribution. By contrast, funds distributed from a Roth IRA (assuming you’re at least age 59½ and meet the applicable holding-period rules) are generally not included in MAGI.

A Roth conversion means taking a portion (or all—but usually not all) of your traditional IRA and converting it to a Roth IRA. The amount you convert counts as taxable income in the calendar year you complete the conversion and is taxed based on that year’s tax rates for your situation.

How it might help

Much like the capital-gain harvesting strategy above, the goal of a Roth conversion strategy in this context is to create a pool of liquid funds you can access later without increasing MAGI.

In other words, you intentionally increase MAGI in 2025 by converting, so that you may be able to:

Keep MAGI lower in 2026, and

Potentially help preserve your 2026 ACA premium tax credit (and possibly credits in later pre-Medicare years).

Quick example

Let’s stick with the same hypothetical couple from southeast Nebraska. We’ll still assume:

They have $50,000 of non-controllable pension income each year.

They want $100,000 of total spending.

But this time we’ll assume they do not have a taxable brokerage account or a Roth IRA. Instead, all of their investable assets are in a traditional IRA.

If they do nothing, then in 2026 they’ll need to withdraw $50,000 (ignoring taxes here to keep the example simple) from their traditional IRAs to reach their $100,000 target spending:

$50,000 pension income + $50,000 traditional IRA withdrawals = $100,000 MAGI

That puts them above the $84,600 income cliff for a household of two in 2026, so they’d be projected to receive no ACA premium tax credit under the “old rules” if those return.

What if they complete a Roth conversion in 2025?

Now assume they choose to complete a $25,000 Roth conversion in 2025:

Their 2025 MAGI is $25,000 higher than it otherwise would have been, and they pay tax on that conversion in 2025.

However, in 2026 they now have a Roth IRA they can tap for some of their living expenses.

In 2026, they might structure their withdrawals like this:

$50,000 pension income

$25,000 traditional IRA withdrawals

$25,000 Roth IRA withdrawals

For ACA purposes, only the first two show up in MAGI:

$50,000 pension income + $25,000 traditional IRA withdrawals = $75,000 MAGI

The remaining $25,000 coming from the Roth IRA does not increase MAGI, but still helps them reach their $100,000 spending goal. As a result, they’re now below the $84,600 cliff for a household of 2 in 2026 and are projected to receive a premium tax credit instead of losing it entirely.

A common point of confusion: the Roth IRA 5-year rules

The Roth rules can be confusing, so let’s clarify what matters here:

There is a 5-year rule for Roth earnings: for earnings in a Roth IRA to be withdrawn tax-free, the Roth IRA generally must have been open for at least 5 tax years and you must be at least age 59½.

There is also a 5-year rule for Roth conversions that determines whether converted amounts might be subject to a 10% early-withdrawal penalty if taken out before age 59½.

In our example:

The couple is in their early 60s (over age 59½), so the 10% penalty on conversions is no longer a concern.

They are withdrawing only the converted principal (the $25,000 they converted), not their Roth earnings.

Long story short: for this couple, under current Roth rules, we’d generally expect the converted amount—but not any new earnings that accrue inside the Roth after the conversion—to be available for tax- and penalty-free distributions at any time after the conversion. The earnings piece would depend on the “5-year since first Roth” rule, but that’s a separate layer most retirees in this situation don’t need to lean on immediately.

Tradeoffs to consider

Much like in the capital-gain example, the tradeoff is:

Potentially higher taxes and/or lower premium tax credits in 2025, in exchange for

Potentially much higher premium tax credits in 2026 (and possibly beyond), thanks to lower MAGI in those years.

You’re essentially shifting income into 2025—when the ACA cliff is not yet in place (but a phaseout does exist)—in order to reduce your income in 2026, when the cliff might be back if current law is allowed to expire.

Whether that tradeoff makes sense depends on your tax brackets, how close you are to the ACA cliff, and your time horizon until Medicare. It’s the kind of scenario where detailed modeling with a tax professional and/or financial planner can be especially helpful.

Longer-term Planning

Again, much like the prior example, if this couple has several years of pre-Medicare ACA coverage ahead of them, they might consider a larger Roth conversion in 2025 to provide liquidity for multiple years, not just 2026.

One additional benefit of this strategy is flexibility in future years. For example, with their specific income cliff at $84,600 in 2026, they could:

Estimate their known 2026 income sources by late in the year,

Compare that estimate to the cliff, and

If there’s still “room” under the cliff, consider doing an additional small Roth conversion near year-end to top up their Roth balance for future years, while still staying below the cliff and preserving their 2026 ACA premium tax credit.

In other words, the plan might be to:

Intentionally rely heavily on Roth withdrawals in 2026 to keep MAGI low, and

If there’s still room under the cliff at year-end (and they’re very confident in their numbers), convert a little more to “refill” the Roth bucket—without pushing themselves over the edge.

If you’re interested in learning more about the potential benefits of tax diversification strategies like this, check out our blog post on the subject here: What Is Tax Diversification? Benefits for Smarter Retirement Taxes — Sanders Retirement Planning

Strategies that involve deductions or income reductions in 2026

Sometimes all that’s needed is a modest “nudge” to get your MAGI back on the safe side of the income cliff. These are the situations where small, targeted moves can be especially effective.

A little farther below, we’ll look at some ideas for reducing 2026 income through deductions or income reductions. But first, it’s helpful to step back and highlight what typically won’t help with the ACA premium tax credit situation (even though these items can help your tax bill overall).

What typically doesn’t help your ACA premium tax credit (but still helps taxes)

These items generally do not reduce the MAGI used for ACA premium tax credit calculations:

The standard deduction or itemized deductions

This includes things like medical expenses over 7.5% of AGI, state and local taxes, mortgage interest, and charitable donations (subject to their usual AGI limits). These are great tools for lowering your taxable income, but they’re taken after AGI is calculated. Since ACA MAGI starts with AGI, these deductions don’t move the needle for premium tax credit purposes.Other “below-the-line” deductions

For example, the Qualified Business Income (QBI) deduction. Again, it can be very helpful for income taxes, but it doesn’t reduce AGI and therefore doesn’t reduce ACA MAGI.Other tax credits

Tax credits (child tax credit, foreign tax credit, etc.) reduce your tax liability, not your income, so they don’t change the MAGI used to determine your ACA premium tax credit.

What might actually help

By contrast, here are some items that can reduce AGI and therefore reduce MAGI for ACA purposes in 2026:

Realizing capital losses in 2026 (or using a capital loss carryforward from 2025 or a prior year)

Realized capital losses can first offset capital gains. If losses exceed gains, up to $3,000 of net capital losses can be used each year to reduce ordinary income. That reduces AGI, which in turn reduces MAGI for ACA premium tax credit purposes.Form 1040, Schedule 1 – “Adjustments to Income”

Certain “above-the-line” deductions on Schedule 1 can reduce AGI. A few that might be relevant:Losses from rental or farm activities (subject to all of the usual rules and limitations).

Traditional IRA contributions – These can reduce AGI if you’re eligible and have earned income. Read our post about IRAs for more in-depth information.

HSA contributions – Unlike traditional IRA contributions, HSA contributions don’t require earned income, but you do need to be enrolled in an HSA-eligible high-deductible health plan.

Other income reductions

If you (or your spouse) are still working but don’t actually need all of your paycheck for living expenses in 2026, you might consider:Pre-tax contributions to employer retirement plans such as a 401(k) or 403(b). These contributions reduce your taxable wages on your W-2, which lowers AGI and therefore may help lower MAGI for ACA purposes.

Used thoughtfully, these kinds of adjustments can sometimes be just enough to pull your projected MAGI back under the cliff and preserve at least part of your premium tax credit for the year.

How to run your own numbers

At this point, you might be thinking, “Okay, this all makes sense in theory — but what does it look like for me?”

Here is a simple framework you can use to start running your own numbers:

Identify your likely household size for 2026.

Count yourself, your spouse (if married and filing jointly), and any tax dependents you expect to claim.

If you’re not sure who belongs in your ACA “household,” use the “Who’s included in your household” guide on HealthCare.gov as a cross-check.

Estimate your 2026 MAGI using the ACA definition.

Start with your most recent tax return and adjust for expected changes: retirement date, Social Security start date, pensions, rental income, etc.

Separate income into your two buckets:

Non-controllable (pensions, certain annuities, etc.) and

Controllable (IRAs, capital gains, Roth conversions, work income you can shelter with pre-tax contributions).

Apply the ACA MAGI definition: AGI plus items like non-taxable Social Security, tax-exempt interest, certain foreign income, and other add-backs we discussed earlier.

Find your approximate cliff number.

Look up the Federal Poverty Level (FPL) for your expected household size for the year being used to determine 2026 subsidies (the Marketplace will specify which year’s FPL table applies).

Multiply that FPL by 4 to get an approximate 400% FPL cliff.

Compare that number to your estimated 2026 MAGI to see whether you’re likely below, near, or above the line.

Use the Marketplace to sanity-check your estimates.

Go to Healthcare.gov (or your state’s Marketplace) and use the “Preview plans and prices” or similar tool.

Enter your household size, ages, ZIP code, and a test income number.

Adjust the income up and down around your cliff number and see how the estimated premium tax credit changes.

Note the point where your credit drops to zero — that’s roughly where the cliff is showing up for your situation.

Decide whether planning could make a meaningful difference.

If your non-controllable income alone is above the cliff, you may not have much room to maneuver from an ACA perspective, and the focus may shift to planning around unsubsidized premiums.

If your non-controllable income is below the cliff but your total projected MAGI is near it, that’s where strategies like capital-gain harvesting, Roth conversions, and 2026 income reductions might be worth modeling more carefully with a professional.

This process won’t give you a perfect forecast — there are always moving parts — but it will give you a much clearer sense of whether you’re miles away from the cliff or uncomfortably close to the edge.

TL;DR – ACA Income Cliff Planning for Retirees Under 65

What’s happening in 2026 (maybe):

If Congress doesn’t extend the current rules, the old ACA system comes back—with a hard income cap at 400% of the Federal Poverty Level (FPL). Go even $1 over that line and your ACA premium tax credit can drop from tens of thousands of dollars per year to $0. For planning, it’s safest to assume that happens and adjust if Congress changes course.Who should care the most:

Retirees under 65 or on ACA/Marketplace coverage whose projected 2026 MAGI is near the 400% FPL cliff (for many two-person households, that’s roughly in the mid–$80,000s, based on current FPL figures) and/or people who have control over when their income is realized.Key concepts:

ACA premium tax credits are based on MAGI for the year you have coverage, not your income from prior years.

MAGI starts with AGI, then adds back a few items like non-taxable Social Security, tax-exempt interest, certain foreign income, and a few others.

Standard/itemized deductions, QBI, and other tax credits can reduce your tax bill, but do not reduce ACA MAGI.

Why this is such a big deal:

Using sample premiums from the Healthcare.gov plan preview tool, a married couple in their early 60s in Nebraska sees an estimated increase of about $26,292 in annual premiums when their income goes from $84,600 to $84,601 in 2026. A single 62-year-old in Iowa loses about $8,952 of annual premium support with a similar $1 income jump from $62,600 to $62,601. These are illustrative estimates only, but they highlight how punishing the cliff can be.Step 1 – Find your cliff:

Look up the FPL for your household size for the year the Marketplace is using to determine subsidies.

Multiply that figure by 4. That number is the exact 400% FPL cutoff under the old rules that are scheduled to return.

Then compare that number to your projected 2026 MAGI.

Step 2 – Separate your income into two buckets:

Non-controllable income: pensions you’ve already started, certain annuities, other fixed payments you can’t easily adjust.

Controllable income: IRA withdrawals (beyond RMDs), timing of capital gains and losses, Roth conversions, and work income you can partially shelter with pre-tax contributions.

Strategy bucket #1 – Pull income into 2025:

o In practice, it’s not always one strategy that gets implemented. It’s often a combination of strategies used together to help drive better outcomes.

Harvest capital gains in 2025 so you can spend from cash in 2026 instead of realizing more gains when the cliff may be in effect.

Do Roth conversions in 2025 so you can draw from a Roth IRA in 2026 without increasing MAGI.

Tradeoff: you may pay more tax in 2025 and may slightly reduce your 2025 ACA credit, but you might protect much larger premium tax credits in 2026 and potentially other pre-Medicare years.

Strategy bucket #2 – Reduce 2026 MAGI where you can:

Realize capital losses (or use carryforwards) to reduce AGI by up to $3,000 beyond offsetting gains.

Use above-the-line deductions (Schedule 1), like eligible traditional IRA contributions, HSA contributions, and certain rental or farm losses.

If still working, increase pre-tax contributions to 401(k)/403(b) plans to lower W-2 wages and AGI.

Mind the edge of the cliff:

The statutory cutoff is at exactly 400% of FPL, but the goal usually isn’t to land $1 below it. Giving yourself some cushion helps avoid surprises (like an extra $1 of bank interest or a slightly higher capital gain unexpectedly costing you a five-figure premium tax credit).Final thought:

All of this is based on current law and current FPL/premium examples. Congress could still extend the enhanced subsidies, change the rules, or do something entirely different. But if you’re in that window — retired, under 65, and on (or planning to be on) ACA coverage in 2026 — doing some planning now, while you still have time to influence 2025 and 2026 income, can make a very real difference in what you pay for health insurance.

All content is for informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. Sanders Retirement Planning LLC does not provide legal or tax advice. Please consult your financial advisor, tax professional, or attorney regarding your specific situation. The information provided is believed to be from reliable sources, but its accuracy and completeness cannot be guaranteed. Links to third-party sites are for informational use only and do not constitute an endorsement. Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Advisory services offered through Sanders Retirement Planning LLC, a Registered Investment Adviser. Services may not be available in all jurisdictions.